“Change the world” is garbage advice

Graduation season is upon us. For those of you set to sweat through hours of boring commencement speeches in the coming weeks, my condolences.

When to Cut Your Losses

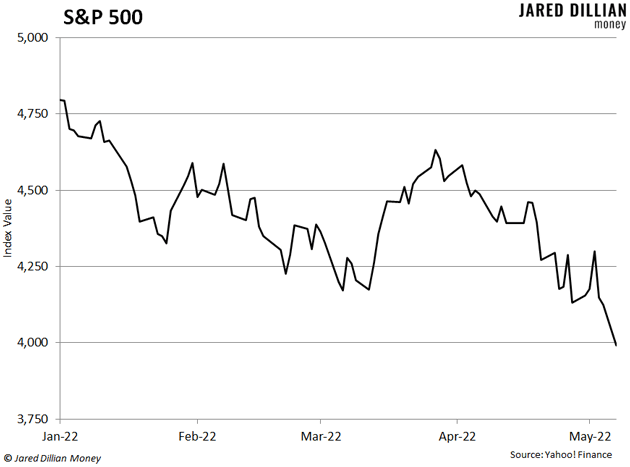

The S&P 500 dropped 3.5% last Thursday, and it’s down around 17% since the start of the year. Many people are wondering if it’s time to cut and run.

The answer to that has two parts—we’ll talk about your speculative or shorter-term investments first.

If you are in a losing trade, and you find yourself hoping and praying things will turn around, you are not doing it right. Hope is not a strategy.

Instead, if you own a stock that’s losing money, you should sell it. Cut your losses and move on. Now obviously, you need to have some tolerance for loss—you don’t have to sell if the stock dips 1%. But if it falls by 20% or more, you should probably sell it.

There are a few reasons for this. First, stocks trend. If they’re going up, they tend to keep going up. If they’re going down, they tend to keep going down.

The reality of the stock market is that turnarounds are rare. Everyone loves to root for the underdog, and that’s fine when you’re watching sports. But with stocks, you want to root for the favorite… for the Yankees.

Second, a losing stock is tying up capital—both your financial capital and your emotional capital. Your money is locked up in a losing investment, and you’re spending a bunch of time checking your brokerage account, wondering whether the stock will recover.

I say this time and time again—I want to help you eliminate financial stress. And you will feel less stress if you sell the loser and move on to other opportunities.

Third, human beings are hardwired to let losses run. If you buy a stock and it drops 20%, your brain will tell you to hang on just a little longer. People who think this way can find themselves riding a stock all the way to zero. Do not be one of these people! Better to surrender and accept defeat. That is how you keep losses small.

Now, the only thing worse than letting your losers run is capping your winners. That is the surest way to become a bad investor.

The way to make big gains is to add to your winning positions. This is the hardest thing in the world to do—it just feels unnatural, but I encourage you to give it a try. Buy a starter position in a stock, and if it goes up, buy a little more. Then, if it continues to go up, buy even more and let it run. In other words, do more of what is working and less of what is not.

What About Your Core Portfolio?

Keep in mind, the guidance we just covered does not apply to your long-term investments, like your 401(k), IRA, or other retirement accounts. That money should be in safe things, like The Awesome Portfolio, with a mix of stocks, bonds, cash, gold, and real estate.

For these accounts, you want to buy on the way up… buy on the way down… buy all the time. This is called “dollar-cost averaging,” and it’s the best way to invest for the long term.

When you know that 90% of your money is squared away in something solid like The Awesome Portfolio, you are free to speculate with the rest.

And that is what the guidance we covered earlier, about selling the losers and adding to the winners, is for—your fun account. Everyone should have one of these—just please remember to cap it at 10% of your investable assets. Chances are you won’t make much, but who knows? Maybe you’ll shoot the moon.

Jared Dillian

|

The Best Way to Manage Inflation’s Effect on YOU

When prices soar, you don’t have to cut every indulgence. Jared has a better strategy.

Enough with austerity. When is it okay to splurge?

Say you get to a point where your financial life is on solid footing. Your mortgage is paid off, you have no other debt, and you’re regularly saving for retirement. What’s next?

Inflation Accelerates to Warp Speed

You probably heard the news yesterday… Inflation hit a 40-year high in March, with the latest Consumer Price Index reaching 8.5%.

‹ First < 20 21 22 23 24 > Last ›